So you’ve decided to take the leap to control your financial future and open a self-directed retirement account. By now you’re probably wondering…what’s in the Solo 401k?

Solo 401k Umbrella

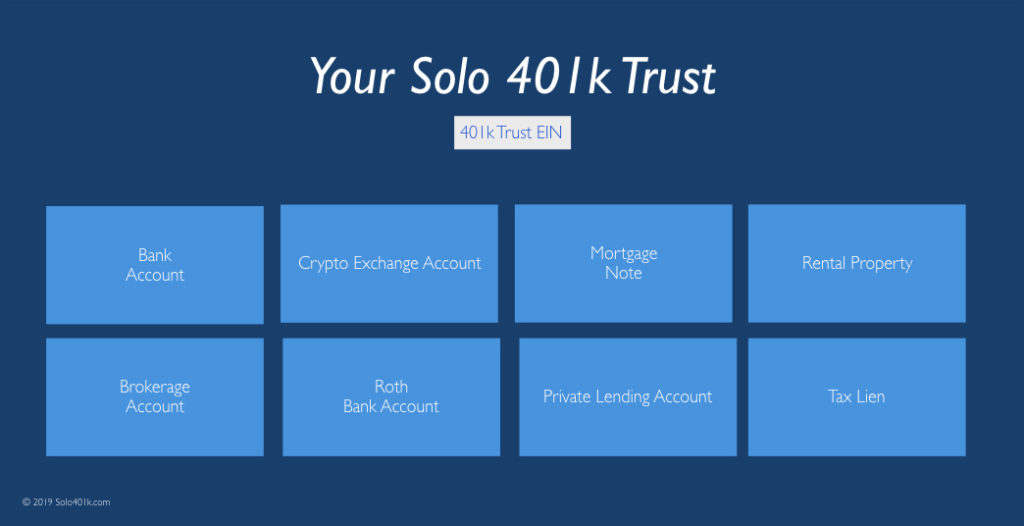

Think of your Solo 401k as an umbrella. Underneath the umbrella you have your plan documents as well as your retirement funds and investments. Your retirement funds might be held in a bank account, brokerage account, or both. Because you are the fiduciary of the Solo 401k plan, you get to choose when, where, and how to invest your retirement funds.

Some popular investments might include:

- Real estate

- Cryptocurrency

- Private placements

- Tax liens

- Promissory and mortgage notes

- Angel investing

- Precious metals like gold & silver

- Traditional equities such as stocks, bonds, and funds

- …and more

Because your Solo 401k plan is an umbrella, which means you can have almost any investment or depository account under it.

As an example, if you like the Fidelity platform for stock market investing, you can do that with the self-directed Solo 401k plan. Your Solo 401k can open a brokerage account almost anywhere. Hence, you get access to your favorite brokerage account platform and investment choices. The only difference is your investment options are created in your self-directed plan, not by the brokerage firm.

Now that you understand the structure, let’s cover what’s included in your plan and trust documents.

Plan and Trust Documents

- IRS Opinion Letter proving the qualified status of your plan

- Trust tax ID number specifically assigned to your Solo 401k trust

- Basic Plan Document

- Adoption Agreement

- Appointment & Acceptance of Trustee

- Resolution of Board of Directors

- Beneficiary Designation

- Death distribution forms

- Rollover acceptance form

- Trust agreement

- Summary Plan Description

- Loan Policy

- Life insurance policy

- In-plan Roth conversion notice and forms

- In-service distribution form

- Plan specifications document

- Required Minimum Distribution form

All in all, your plan and trust documents total well over 300 pages! To make things simple for you, we prepare a Signature Pages packet that’s ready for you to sign with all the documents extracted from the plan and trust that require your signature.

With a self-directed Solo 401k, there is no need to send any of the signed pages to your plan sponsor. Remember, you are you own plan administrator, so you are responsible for keeping great records of your investments, transactions, and paperwork. Once your plan signature pages are signed, your Solo 401k is officially in existence and your next step is to open a depository account for your 401k money, and fund your plan via rollovers or contributions.

Roth Solo 401k

The Solo 401k by Nabers Group also automatically includes a Roth Solo 401k in your plan and trust. This means you can make Roth after-tax contributions and grow your wealth tax-free. Some investors even use their Roth accounts to become millionaires. It’s important you keep good records of the money coming in and going out of your retirement plan. Therefore, most CPAs will recommend you have a separate bank or brokerage account to hold your Roth funds.

Spouse Account

Your Solo 401k can also include a spousal account. If your spouse works in your business with you, then (s)he may participate in your self-directed Solo 401k plan, too. When a spouse participates in the plan, (s)he can rollover funds from other retirement accounts. Additionally, if you pay your spouse for the work they do in your business, they can even contribute new funds to the Solo 401k.

Retirement plan contributions can be tax-deductible, Roth, or after-tax (non-deductible). As mentioned above, it’s important to keep good records of your retirement funds. If both you and your spouse take advantage of the pre-tax and Roth accounts in the Solo 401k, you may end up with 4 different bank accounts, all under one Solo 401k umbrella.

Conclusion

There’s a lot included in your Solo 401k plan, from documents dictating how you can invest to knowing the actual structure of using different tax-classified funds. It’s important to work with a document provider who has experience, a stellar reputation, and will be there to help.

Do you have questions about what’s in the Solo 401k plan? Leave us a comment below!