Today kicks off of our 7-Part Series on how to “Start Investing with your Solo 401k”. In our first installment, we’ll cover Gold & Silver.

The key to having a solid retirement account is a well-balanced portfolio. If one asset isn’t doing well, the other assets can pick up the slack. With some carefully chosen investments, you too can have a well-balanced portfolio. Investing Gold and silver in a retirement account may also be a good hedge as they are typically uncorrelated from the stock market. Additionally, there are some specific scenarios to consider where gold & silver can prove valuable.

Precious Metals and Hyperinflation

Gold & silver aren’t high ROI assets in today’s economy. Typically, metals have less than a 1% annual ROI. Why then, would you consider it for your portfolio?

Gold and silver historically shine during a currency crisis. In a hyperinflation scenario, fiat currency rapidly loses its value to inflation in a very short span of time. In a stable economy, $1300 could buy you a nice suit. During hyperinflation, that same $1300 may not even buy you a shirt.

The government generally reports an annual inflation rate of 3-5% with the US dollar. In a hyperinflation scenario, some countries have experience a 100% rate of inflation a much shorter time.

What is fiat money?

Fiat money is any currency not backed by physical gold or silver. It retains value only because the government has deemed it valuable.

In 1971, President Nixon took the United States off of the gold standard. This converted the US dollar from secure money to fiat money. Coincidentally, this is also when the dollar began to lose its purchasing power. Because the dollar is no longer tied to real assets such as gold and silver, there is no way to ensure the purchasing power remains steady. Thus creates inflation.

Historically, in a currency crisis, people return to gold and silver as a method of payment, because it is a more stable form of money.

Could the US dollar ever collapse?

Could the US dollar ever collapse?

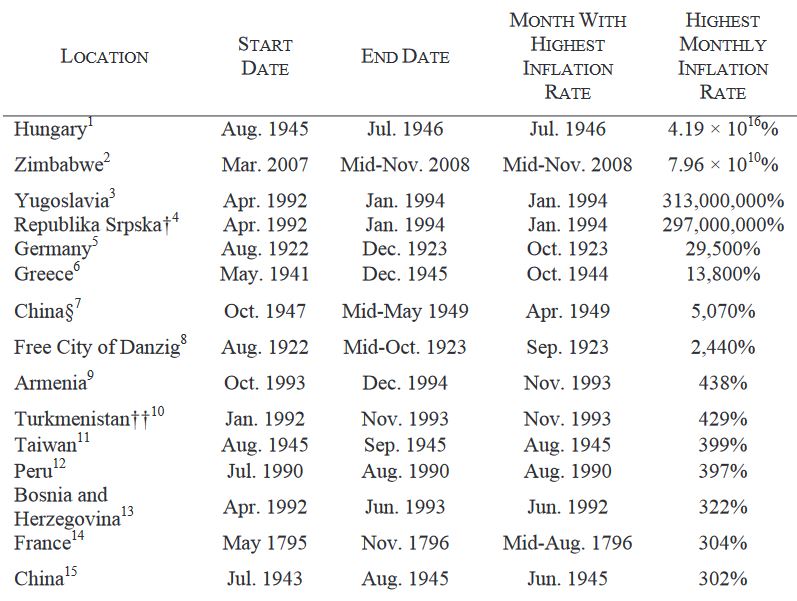

The historical rate of failure for fiat currency systems is 100%. The Hanke-Krus World Hyperinflation Table to the right shows some countries who have already experienced hyperinflation.

In viewing the entire chart, you may notice a trend. All fiat currencies in history eventually experience hyperinflation. Once a currency loses its stable supply and backing from gold and silver, it starts on a path of inflation until the eventual hyperinflation and collapse of that currency.

The US Dollar has been a fiat currency for almost 50 years. Given the history of failure of fiat currency, the chances of a currency crisis, even for the US Dollar are not to be ignored. Therefore, holding some precious metals in your portfolio should be considered.

Once you have gold and silver in your portfolio, you need to know how and when to use them. Additionally, in the case of a currency crisis, you’ll want to think both short and long-term. Let’s discuss those two timeframes now.

Crisis Funds

Keep crisis funds easily accessible in the case of currency collapse or hyperinflation. Having some crisis funds can enable you to continue to your day to day lives in the early days of a crisis with less panic.

During a currency crisis or hyperinflation, it may become more difficult to buy food, pay rent/mortgage, or even live in a safe area with dollars. A loaf of bread one day might cost $5 and the next day could cost $50. Having a crisis fund of gold and silver can allow you to instead use precious metals to pay for daily essentials. Instead of using rapidly devaluing dollars, you could pay with gold/silver.

Because you may need quick and easy access to these funds, it’s not recommended that you purchase crisis fund metals with your Solo 401k. Instead, consider buying these metals with personal funds. This way you can store them at your home, or somewhere nearby that is easily accessible. However, don’t keep too much metals at home to avoid becoming a target for theft. Keep only what you might need to survive in the early days of a crisis. For most families, this will typically be $10,000-$20,000 in gold and silver coins.

Survival Funds

As a currency crisis continues, distressed assets may flood the market. If you are properly prepared, this can be a valuable opportunity to buy assets at distressed prices. If you hold some metals in your retirement account, you might be able to purchase these distressed assets for your portfolio.

Consider buying survival fund metals with the Roth portion of the Solo 401k. By purchasing metals with after-tax funds, your purchase of distressed assets may multiply exponentially. Because you are holding the after-tax investments in metals instead of dollars, you lessen your exposure to hyperinflation if/when the dollar value drops. In trading after-tax gold for distressed assets, later withdrawals could be tax-free.

Where can I buy metals?

If you plan to buy gold and silver to store at home, consider Kitco.com to purchase online and have metals shipped to you. For buying less than $50,000 of metals with your Solo 401k, consider Goldmoney.com. Goldmoney can also store the coins for you. If you’re buying more than $50,000 you want to invest in gold/silver with your Solo 401k, reach out to us for a recommendation on the best purchasing and storage solution.

What to know before buying metals with the Solo 401k

- Don’t buy too much with your retirement account. In the case of hyperinflation, your precious metals may be worth much more than they were at the time of purchase. This can be a problem if you take distributions. If you distribute a million dollars, your tax bracket could be quite high and you could lose much of your money to taxes.

- It’s generally recommended you use a safety deposit box, and not keep metals at home. Most banks will allow you to open a lock box for your Solo 401k to store the metals.

- Don’t buy collectible coins. The IRS prohibits the Solo 401k from holding collectibles, including gold/silver coins

- Stick to American Eagles when buying metals with retirement funds.

- Avoid Gold ETFs/gold stocks as your crisis hedge. In the case of hyperinflation or a currency crisis, Wall Street could be affected. Real metals may carry more value than a paper claim in the stock market.

Click here to read more about buying precious metals with your Solo 401k.

Do you want input from the experts who have put over 2,000 hours of research into precious metals? Are you interested in holding metals in your Solo 401k? Call us at 877-765-6401 or send us a message at [email protected] for more information.

DISCLAIMER: At publish time, Nabers Group are not affiliated with any of the sites listed in this article and does not receive incentives for any referrals.