The Solo 401k is the most powerful retirement account on the planet when it comes to contributions. This can add up to huge tax savings for you if you own your own business. When you run your own retirement account, you need access to the best tools. Fortunately, all Solo 401k account holders with Nabers Group have access to our contribution calculator. Let’s walk through how to use the calculator, determine how much you can contribute to a Solo 401k plan.

Click here to access our Solo 401k contribution calculator

Highest Contribution Limits of All Retirement Plans

With a traditional IRA, you can contribute up to $6,00 per year. But with a Solo 401k, you can contribute up to $57,000 per year. Double that if you’re married!

The reason you can contribute (and deduct) so much money with the Solo 401k is because you are both the employer and the employee in your business. Essentially, this allows you to make two types of contributions, maxing out more than any other retirement plan.

Let me show you how to calculate your contributions with the Solo 401k Contribution Calculator.

Solo 401k Contribution Example: Sole Proprietor

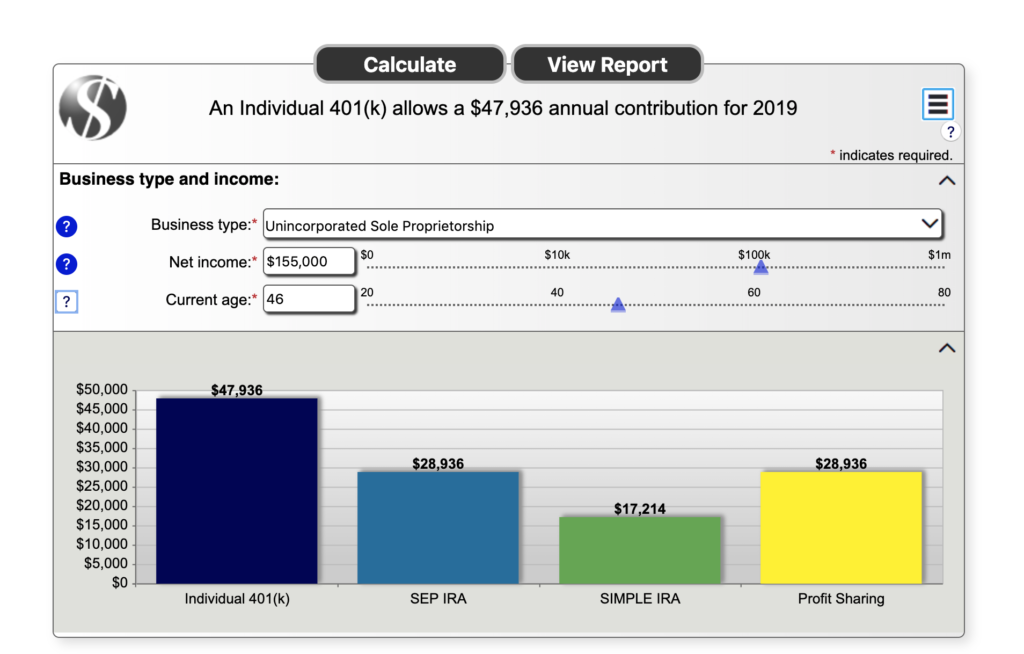

First, input your business entity type as the contribution limits vary slightly based on your business structure.

- Select “Unincorporated sole proprietorship” if your business is just you, or a single-member LLC.

- Next input your net income.

- Input your age

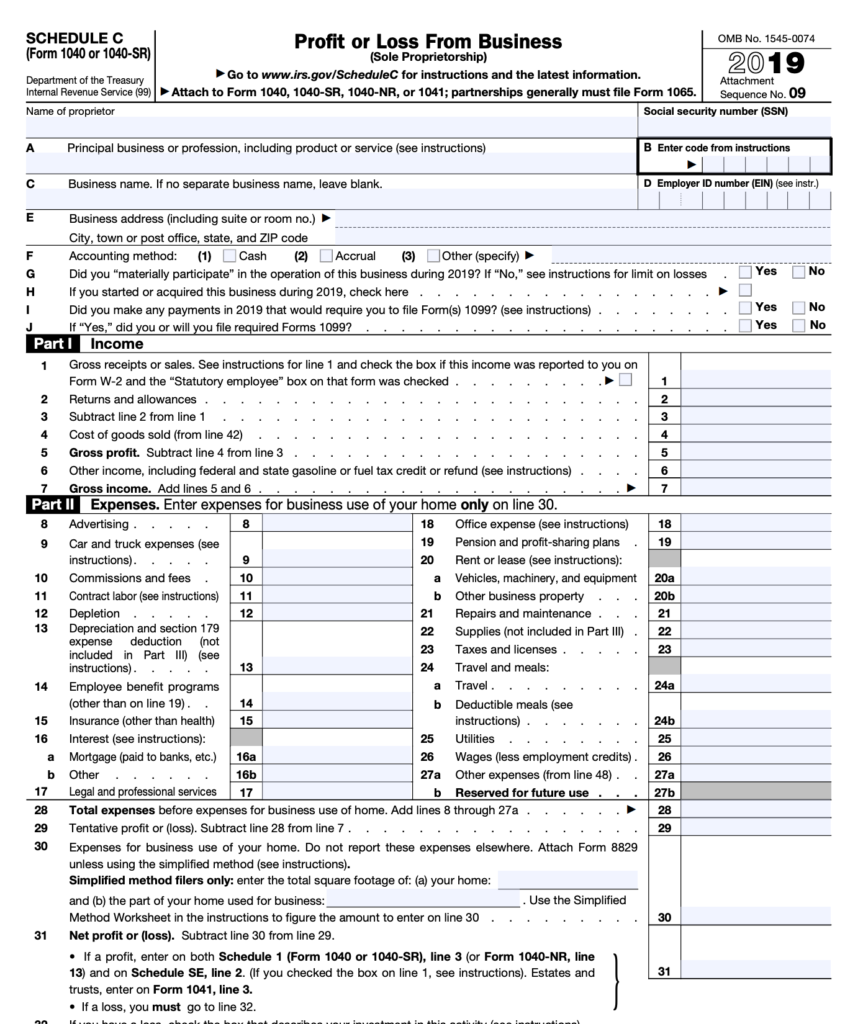

If you are a sole proprietor, this is the net compensation you were paid from your business. Generally this will show up on Line 31 in Schedule C of your income tax return.

Let’s say your business earns a gross revenue of $250,000. You typically have about $95,000 in expenses, which leaves $155,000 as your net income as shown on Schedule C of your IRS Form 1040 tax return.

Input $155,000 into the calculator.

Finally, input your age. If you are age 50 or older, you get an extra $6,000 of catch-up contributions you can make to the Solo 401k plan. (Contribution limits have gone up slightly for 2020 cost of living increase. This blog post will use 2019 figures as many Solo 401k account holders are still making contributions for the 2019 tax year.

Click “View Report” to see an exact breakdown of how to contribute the employee versus employer portion of funds.

Calculator Results

If you were to have a traditional IRA, you would be limited to a contribution of $6,000.

A SEP IRA allows a total contribution of $28,936. A SIMPLE IRA will let you contribute $17,214. You can contribute up to $28,936 with a profit sharing plan.

With the Solo 401k, you can contribute $47,936.

Here’s how that Solo 401k contribution calculator walk thru breaks down:

$19,000 – employee salary deferral contribution + $28,936 – employer profit sharing contribution = $47,936 total contribution. Remember, your Solo 401k contribution is tax deductible. That means you reduce your taxable income by the amount you contribute. In many cases, this can move you into a lower tax bracket.

Solo 401k Contribution Calculator: S-corp

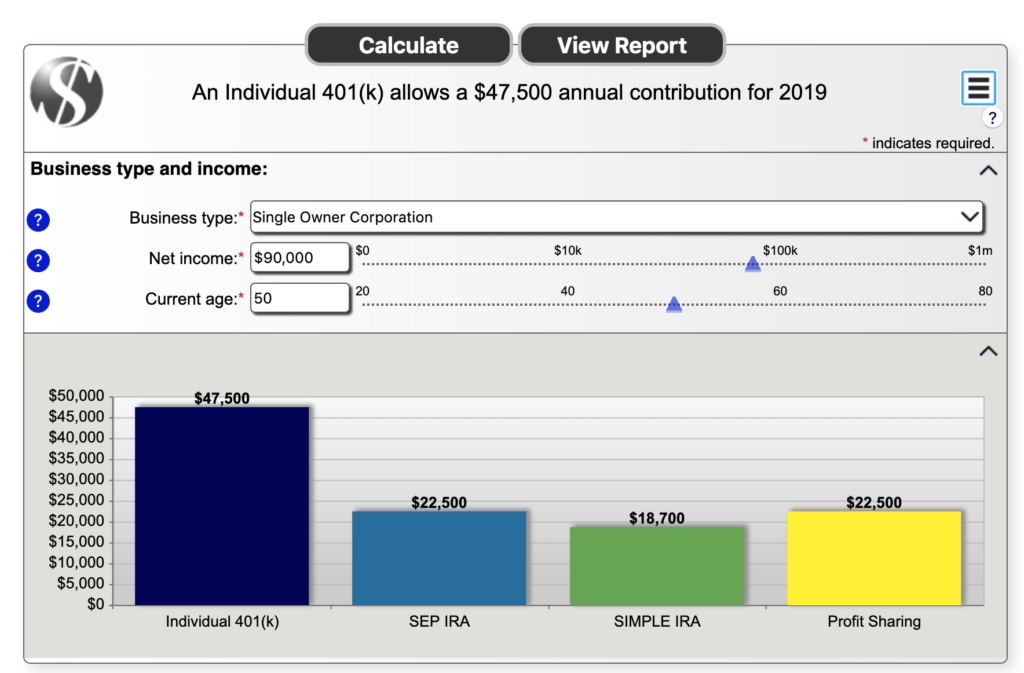

Let’s go over another example where your business is a corporation, with you and your spouse both as members. Start by selecting “Single-owner corporation” if your business is an LLC taxed as an S-Corp, a multi-member LLC, an S-corp or a C-corp.

Your business will file IRS tax form 1120 and each partner (you and your spouse) will receive a W-2. According to the IRS, all Solo 401k contributions from your S-corp must come from your W-2 wages (not 1120s owner distributions).

For purposes of this example, let’s assume the wages on your W-2 is $90,000 and wages on your spouse’s W-2 is $55,000. We’ll start with your contribution calculation first – input $90,000 into the calculator since that is the net compensation listed on your W2.

With the Solo 401k, you can contribute $47,500 (almost 3 times the amount of a Simple IRA and double what you can contribute with a SEP).

The Math:

$19,000 Employee contribution

$6,000 Catch-up contribution because you are over age 50

$22,500 employer contribution (25% of your $90,000 in W2 wages)

Total: $47,500 in tax-deductible contributions

Now let’s calculate your wife’s contribution. Remember, she made $55,000 in net compensation on her W2.

Based on her net earnings, your wife is able to contribute $32,750.

The Math:

$19,000 Employee contribution

$13,750 Employer contribution (25% of her $55,000 W2 wages)

Total: $32,750

With your combined net compensation of $145,000 ($90k in earnings for you and $55k in earnings for your wife), you are able to make a grand total tax deductible contribution of $80,250! That will make a huge dent in your remaining taxable income.

Conclusion

As you can see, using the Solo 401k Contribution Calculator can be a powerful tool to determine how reduce your taxes significantly. The Solo 401k is the most powerful retirement plan available to you.

Here’s a few helpful hints to ensure you get the most out of your contribution calculation:

- You and your spouse can each contribute separate amounts, based on what you’re earning from your business.

- Your contribution amounts can change every year, based on how much your business is making

- The Nabers Group Solo 401k plan includes Roth contributions and voluntary after-tax contributions in addition to tax-deductible contributions

Have questions about Solo 401k contributions? Check out the replay of our most recent contribution calculator webinar walk-thru here.

Our expert team is ready to help. Contact us today at 877-SOLO-401.