Retirement accounts have two types of tax distinction: pre-tax (traditional) and after-tax Roth) funds. Traditional retirement accounts have the benefits of saving money for retirement while delaying the need to pay taxes on that money. A designated Roth account is a powerful tool for growing your money tax-free.

Roth retirement accounts allow funds to be contributed to a retirement account after paying taxes on them. The benefit here is that you won’t have to pay taxes when you distribute the funds years later. This is especially advantageous if you believe your tax rate will be higher at retirement age.

Generally when we hear the word “Roth” we simply think ‘post tax retirement funds’. What is often unknown is that not all Roth accounts are created equally.

Let’s cover the basics of the Roth IRA and Designated Roth account in the Solo 401k below:

What is a Roth IRA?

A Roth IRA is an account that can be opened with an IRA custodian. In order to contribute both Roth IRA funds and Traditional IRA funds, 2 accounts will need to be opened: a Traditional IRA and a Roth IRA.

Roth IRAs allow you to contribute up to $5,500 (or $6,500 if you’re 50 years of age or older) per year, post-tax.

There are no Required Minimum Distributions (RMDs) for Roth IRAs. This is especially useful if you have more than enough money at retirement age and you want to pass on funds to heirs.

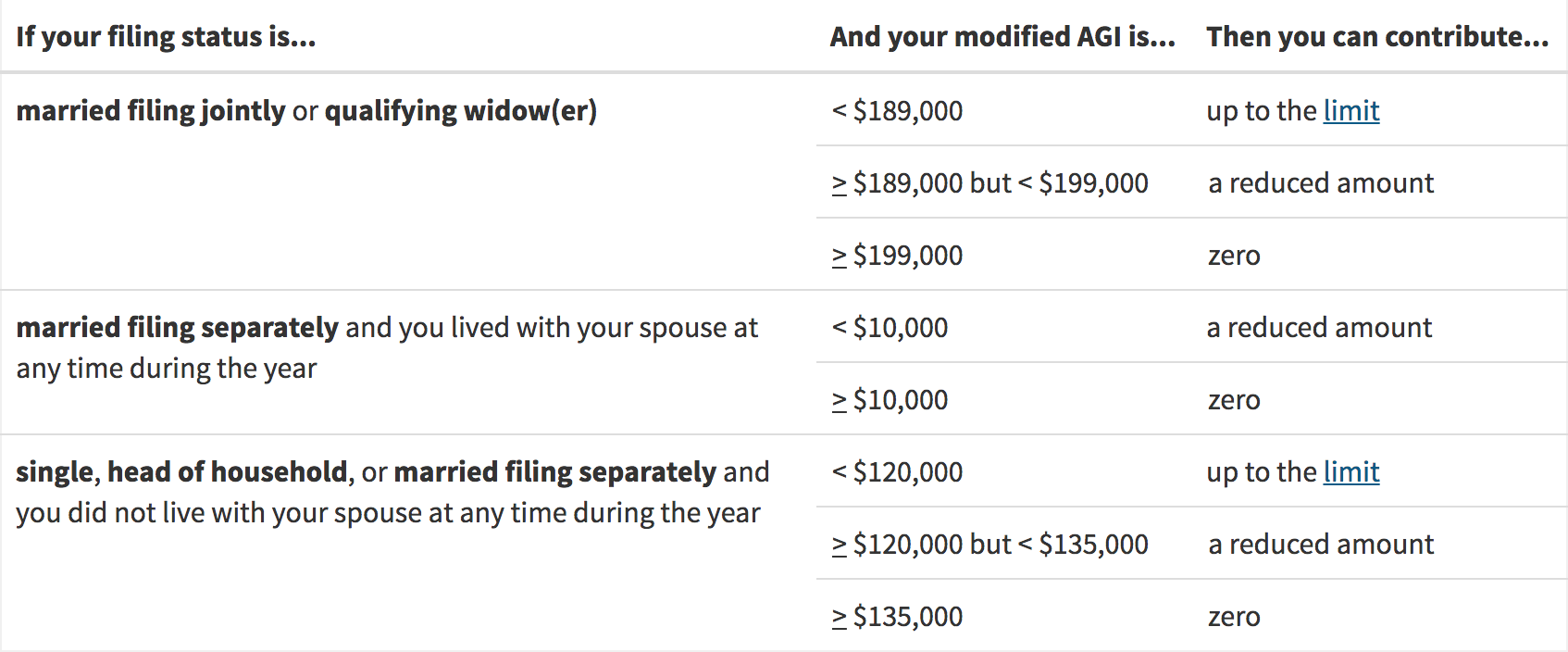

Not everyone is eligible to contribute to a Roth IRA. If you make too high of income, you often are excluded from contributing to a Roth IRA. For 2018, you can contribute the maximum amount if your modified adjusted gross income is under $120,000. The amount you can contribute goes down as modified adjusted gross income goes up.

You can only contribute as much as you have earned as income. For example, if you make $1,000 in one year, you can only contribute $1,000.

Roth IRA funds cannot be rolled into a traditional IRA, or even a Roth 401k account. Roth IRA funds can only be rolled into another Roth IRA.

What is a designated Roth account in the Solo 401k?

The designated Roth account is a type of Roth sub-account built into the Solo 401k. The designated Roth account allows for Roth contributions to the Solo 401k. Accurate accounting is required to keep Roth funds separate from non-Roth funds. It is also recommended that a separate bank account is kept for Roth funds and non-Roth funds.

Designated Roth accounts allow you to contribute up to $18,500 (or $24,500 if you’re 50 years of age or older) per year, post-tax. (IRS Source)

While a Roth IRA doesn’t have any Required Minimum Distributions, the designated Roth account does, even in a Solo 401k plan. There are Required Minimum Distributions (RMDs) for Designated Roth accounts once the participant reaches age 70 ½.

As long as you qualify for the Solo 401k plan, you can contribute to the Designated Roth account. There are no limitations for Roth Solo 401k contributions based on your income.

Like the Roth IRA, you can only contribute as much as you have earned in income to your Roth Solo 401k plan.

A designated Roth account can be rolled over into another designated Roth account or a Roth IRA.

As discussed, with a Roth IRA those funds must be kept separate from your traditional IRA. Therefore, you’ll end up with two retirement accounts if you are using a Roth and traditional IRA. With the Roth portion of the Solo 401k, the designated Roth account is already built into the Solo 401k plan. Therefore, you don’t need to open a separate account and pay fees for 2 different accounts. Your Solo 401k plan automatically includes sub-accounts for both traditional and Roth funds.

The benefits of the Designated Roth account vs. Roth IRA are:

- You can contribute more than 3 times as much to a designated Roth account with a Solo 401k plan than to a Roth IRA

- The Designated Roth account does not have a limitation based on modified adjusted gross income.

- Roth and non-Roth funds are inside one Solo 401k vehicle instead of having to maintain two retirement accounts.

- The Designated Roth account in the Solo 401k has more freedom with rollovers since you can roll Roth 401k funds to a Roth IRA but once funds are in a Roth IRA they are stuck there!

The drawback of the Designated Roth account vs. Roth IRA is:

- The Designated Roth account has to pay out RMDs at age 70 ½ while the Roth IRA has no required minimum distributions

Which is right for you?

Deciding which Roth retirement vehicle is right for you is an incredibly personal decision. Some of our accountholders at Nabers Group choose to begin their Roth journey with the Designated Roth account in the Solo 401k. This account allows the accountholder to contribute more and is not limited by the amount of income earned by the retirement account owner.

Later, you might choose to roll those funds from the Designated Roth account in your Solo 401k to a Roth IRA. Or, you might even choose to have the best of both worlds:

- Open a Roth IRA and fund it with a small portion of funds (do this only if you don’t make too much money to contribute to a Roth IRA)

- Open your Solo 401k with Nabers Group and get immediate access to the Designated Roth Account contained therein

- Fund your Designated Roth account with rollovers from another Roth 401k plan, or even do an in-plan Roth conversion in your Solo 401k

- Before you reach age 70.5, begin to roll funds from your Designated Roth account in the Solo 401k to your Roth IRA. This way you can avoid the Required Minimum Distributions from the Roth portion of your retirement funds

Please note in order for your Roth IRA to be qualified (i.e. not pay taxes on the withdrawal) you must have had your Roth IRA open and funded for at least 5 years and be age 59.5 or older.